WASHINGTON — Thousands of college students locally – and more than 500,000 in cities and towns across America – have been stripped of more than a billion dollars in aid following the Senate’s refusal to renew the nation’s oldest loan program for college students.

The 57-year-old federal Perkins loan program expired at the end of September after the Republican-controlled Senate, led by Sen. Lamar Alexander (R-Tenn.), chair of the Senate Health, Education, Labor and Pensions Committee, blocked legislation to extend it even after the legislation passed the House of Representatives where Republicans hold an even larger majority.

Students with exceptional financial need can borrow up to $5,000 at a 5 percent fixed rate. The program serves close to 1,700 schools and in the 2013-14 academic year awarded over $1.15 billion in aid to over 539,000 students according to the U.S. Department of Education.

Approximatively 5,000 District college students received over $16 million in Perkins aid last year, according to the Department of Education.

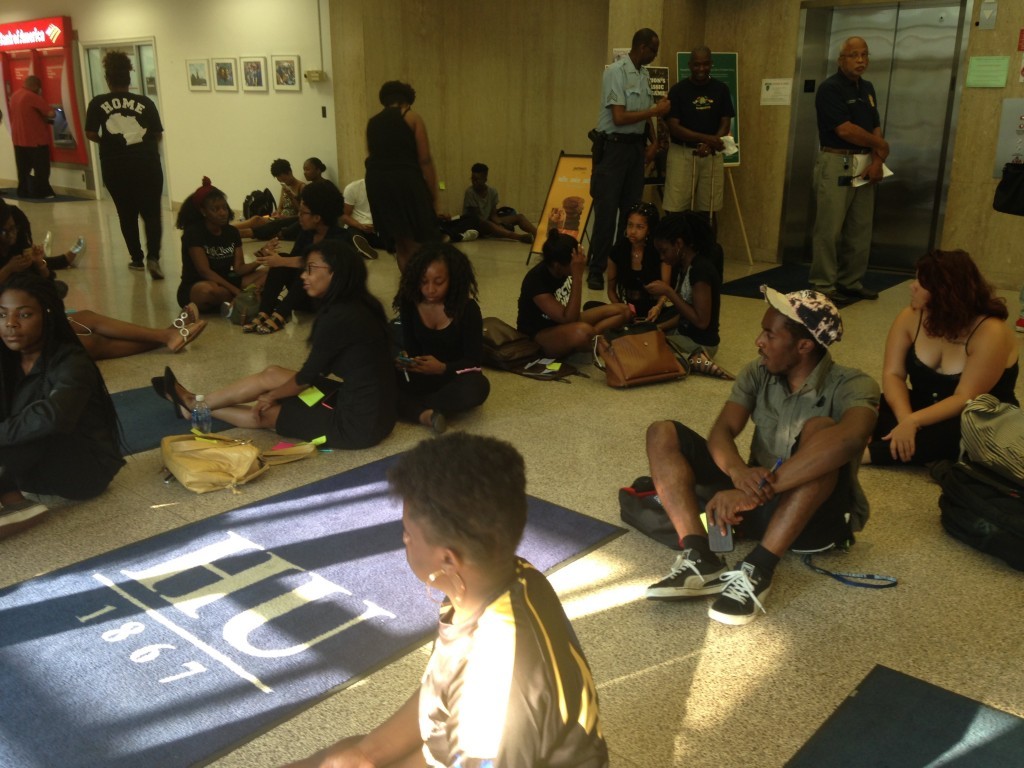

Brian Johnson, associate director of financial aid at Howard University, said the loans have been a boost to needy students and the absence of the funding could create a huge strain on the university and its students.

“It’s been great, because it has assisted students who had difficulty meeting the financial obligations with the university,” Johnson said. “Now students who usually received those funds will have to seek funding from other sources. Hopefully we will be able to assist students with other resources, but again, that will be challenging for those students who were recipients in the past.”

On average, District of Columbia students borrow more than other states or providences that participate in the program. They borrowing on average $ 3,351, compared to the national average of $2,172 per student.

Catholic University officials said the school will also feel strain from the dissolvent of Perkins loans. Its students received $1.2 million in aid the last year and were awarded on average $ 2,000 each, according to Jo Ann Humphreys, assistant director of financial aid at Catholic University.

“We are trying to deal with it as best as possible,” Humphreys said, “We tried to provide deadlines to encourage them to get there promissory note done in time.”

Nearly all Washington schools will be affected to some degree, according to Department of Education statistics. At George Washington University, 2,237 student received more than $4 million in loans for the 2013-2014 year, and at Georgetown, just over 1,200 students received nearly $8.5 million.

Some historically black colleges and universities will also take a hit. For instance, Hampton University in Virginia will lose about $1 million, nearly 500 students at Tuskegee University will lose $1.7 million and 15 percent of the students at Clark Atlanta University who receive the loans will go without $1.3 million.

Starting Oct. 1, some candidates may still receive the loan on a limited basis, according to Miriam Niblack, assistant director of Georgetown University Student Loan Services.

“Students who accepted the loan prior to September 30, 2015, are able to be grandfathered into the program and still receive funds on a limited basis upon meeting certain criteria,” Niblack said.

“Those who have the loan can continue to use the benefits of the program until it is exhausted or the loan is repaid. After any final disbursements, without the program being re-instituted, the loan will no longer be available.”

For those who are not grandfathered in or future student in need, the prognosis seems much bleaker. if the program is not reinstated or extended within the next two months.

“The biggest burden will be for those students who had that shortcoming, because they won’t have access to those resources anymore,” Johnson said.